Decode Options Market Flow with

OptionWhales

Real-time unusual options activity detection. Spot large sweeps, institutional bursts, and sentiment shifts before the crowd. Where generative AI meet market microstructure.

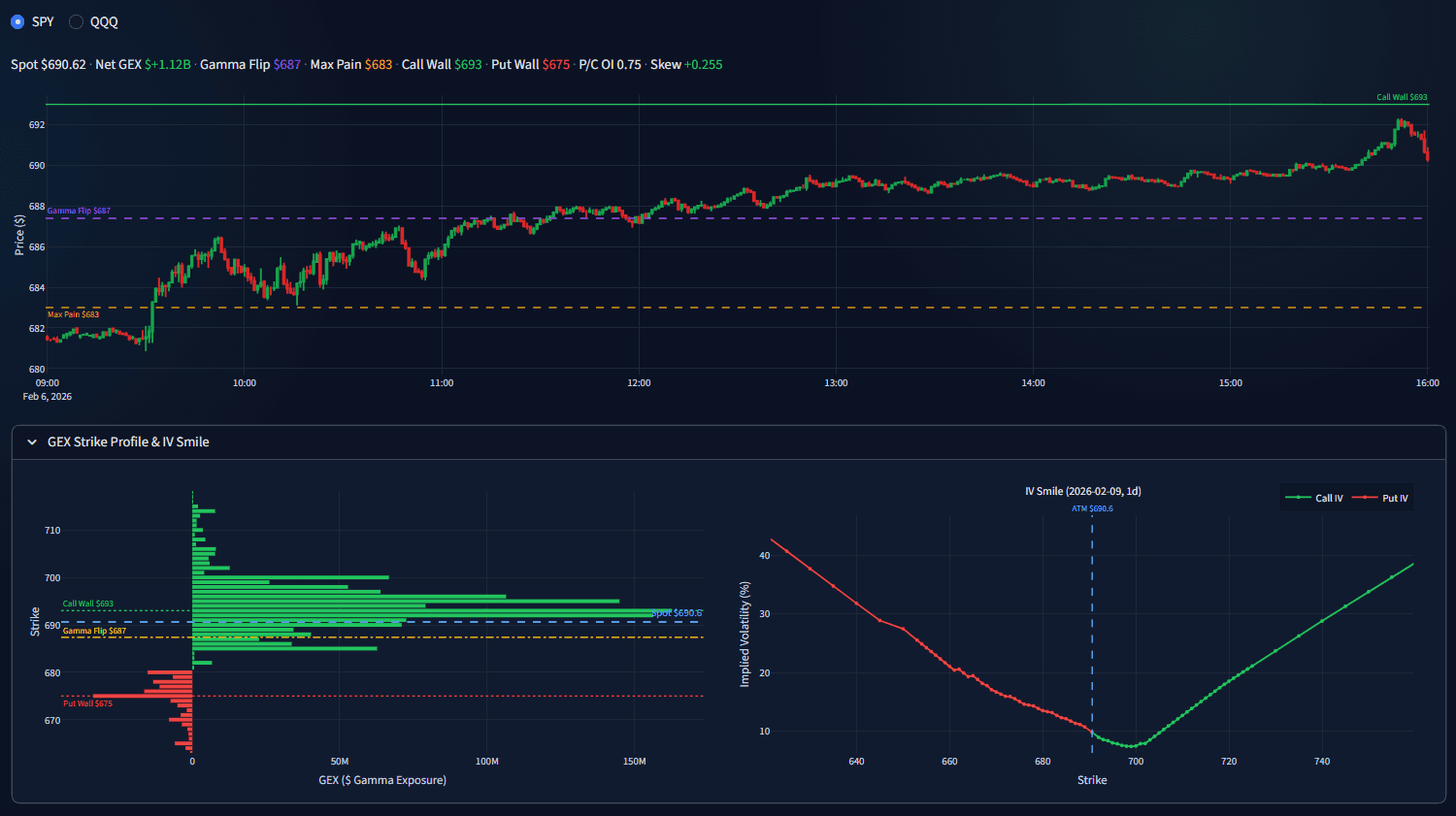

Real-Time Gamma Exposure Analytics

0DTE options now dominate daily volume. Our GEX engine computes dealer gamma in real time, revealing the hidden support and resistance levels that drive intraday price action. Know where the walls are — before the market tests them.

Sample: SPY 0DTE GEX Strike Profile & IV Smile — Feb 10, 2026

Key Levels, Explained

Net GEX

Aggregate Gamma Exposure across all strikes. Positive GEX means dealer hedging dampens volatility; negative GEX amplifies moves.

Gamma Flip

The strike price where dealer gamma shifts from positive to negative. A critical inflection point that defines the volatility regime.

Call Wall

The strike with the highest call gamma — acts as a magnetic resistance level where dealer hedging pins price action.

Put Wall

The strike with the highest put gamma — a key support level. Dealers buy dips here, creating a floor under the market.

Max Pain

The strike where total option buyer losses are maximized. Price tends to gravitate here as expiration approaches.

IV Smile

Implied Volatility across strikes reveals skew and sentiment. Steeper smiles signal fear; flat smiles signal complacency.

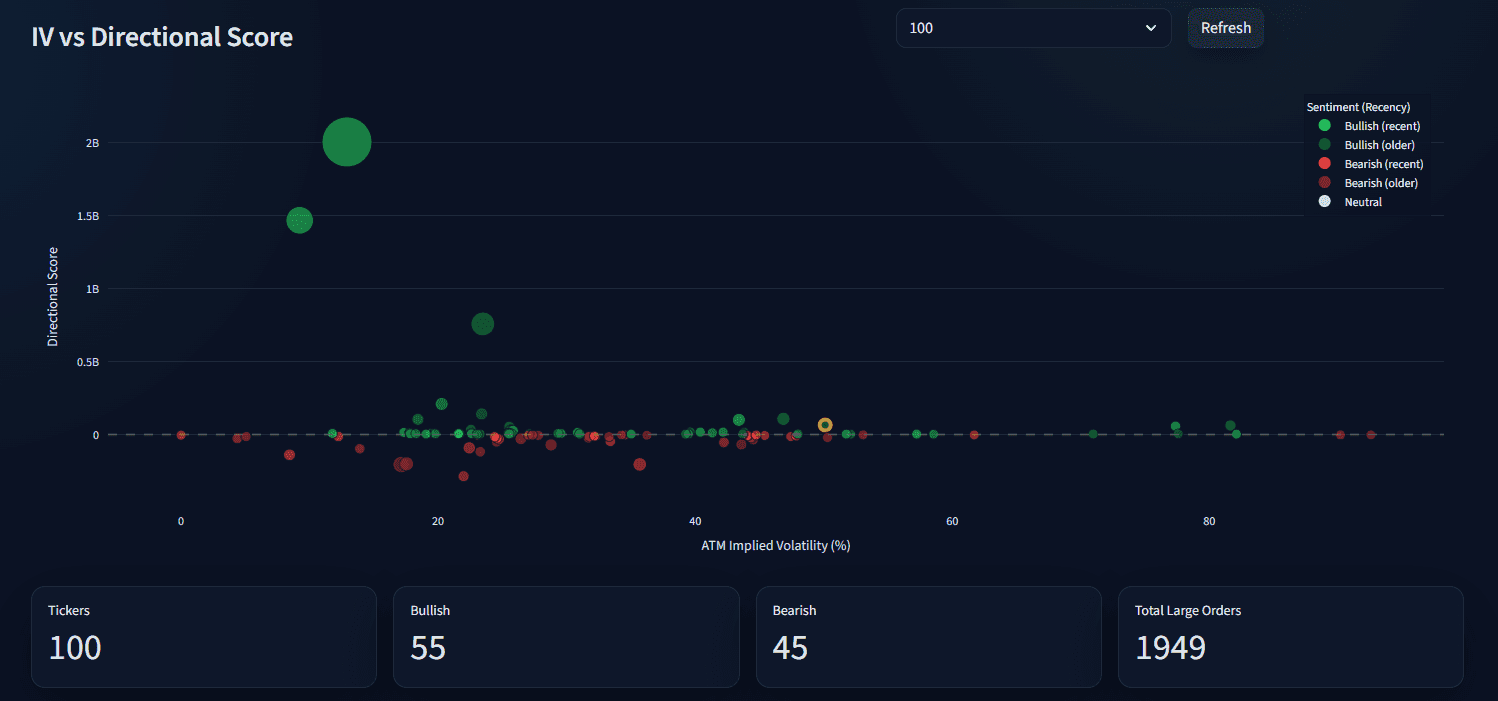

Spot Unusual Activity at a Glance

Every dot is an options trade — sized by premium, colored by sentiment. Scan the entire market in one view, then click any ticker to drill down into strike-level flow, intraday charts, and AI-generated whale reports.

Everything You Need to Decode Flow

Professional-grade options flow intelligence, powered by AI and designed for traders who demand precision.

Unusual Options Activity

Instantly detect anomalous volume spikes and unusual options trades that signal institutional interest.

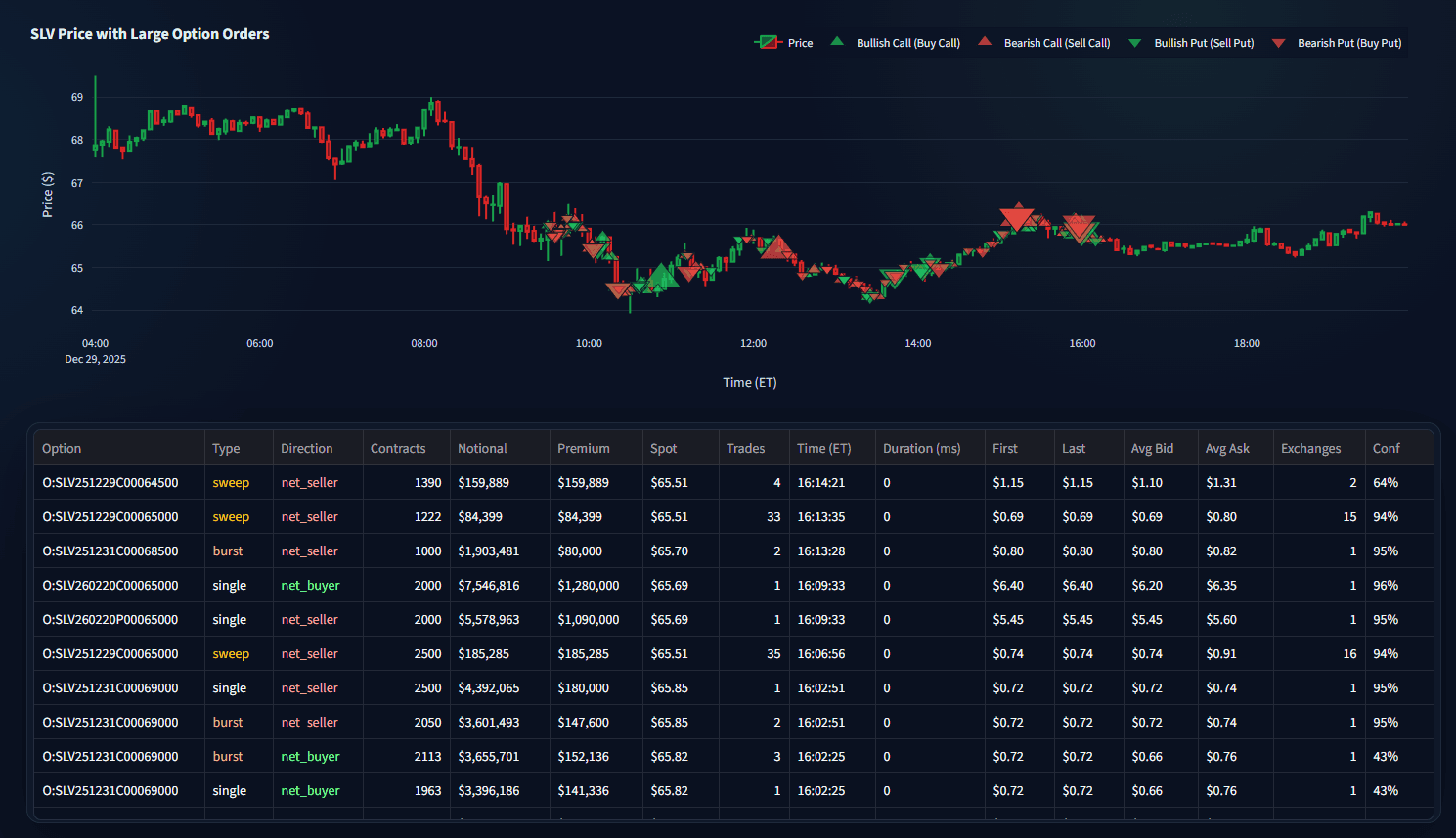

Large Sweep Detection

Track aggressive sweep orders and multi-exchange bursts as smart money moves quickly across venues.

Direction Score

AI-powered sentiment scoring classifies flow as bullish or bearish with NBBO buy/sell inference.

Per-Ticker Drilldown

Click any ticker for deep-dive analysis: strike distribution, expiry heatmaps, and historical context.

Smart Watchlists

Build custom watchlists and track flow patterns across your favorite tickers in real-time.

Instant Alerts

Get notified when unusual activity hits your watchlist or custom flow thresholds are breached.

Intraday Flow Analysis

Visualize how options flow evolves throughout the trading day with time-series breakdowns.

Institutional-Grade Data

Process millions of options trades daily with sub-second latency and 99.9% uptime reliability.

Built for Every Edge-Seeker

Whether you're scalping sweeps or building quant models, FlowScope adapts to your style.

Spot Momentum Before It Moves

Identify large sweeps and unusual volume in real-time. Filter noise and focus on institutional-grade signals that matter for your next trade.

- Real-time sweep alerts

- Volume spike detection

- Direction scoring

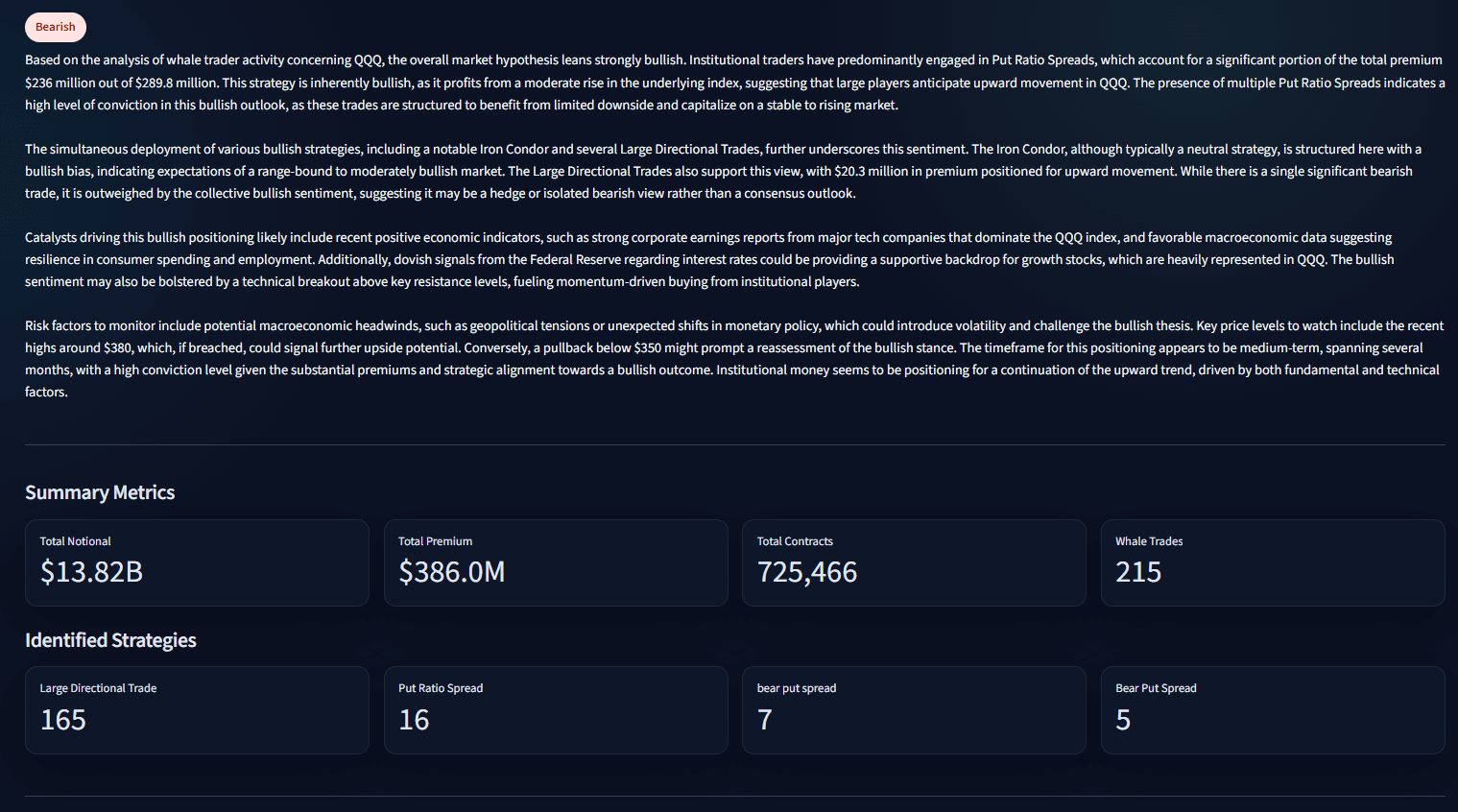

Where AI Meets Market Microstructure

Leverage advanced AI analysis to decode complex market patterns. Our intelligent system transforms raw options flow into actionable insights, revealing institutional behavior and hidden opportunities.

- AI pattern detection

- Institutional behavior tracking

- Predictive analytics

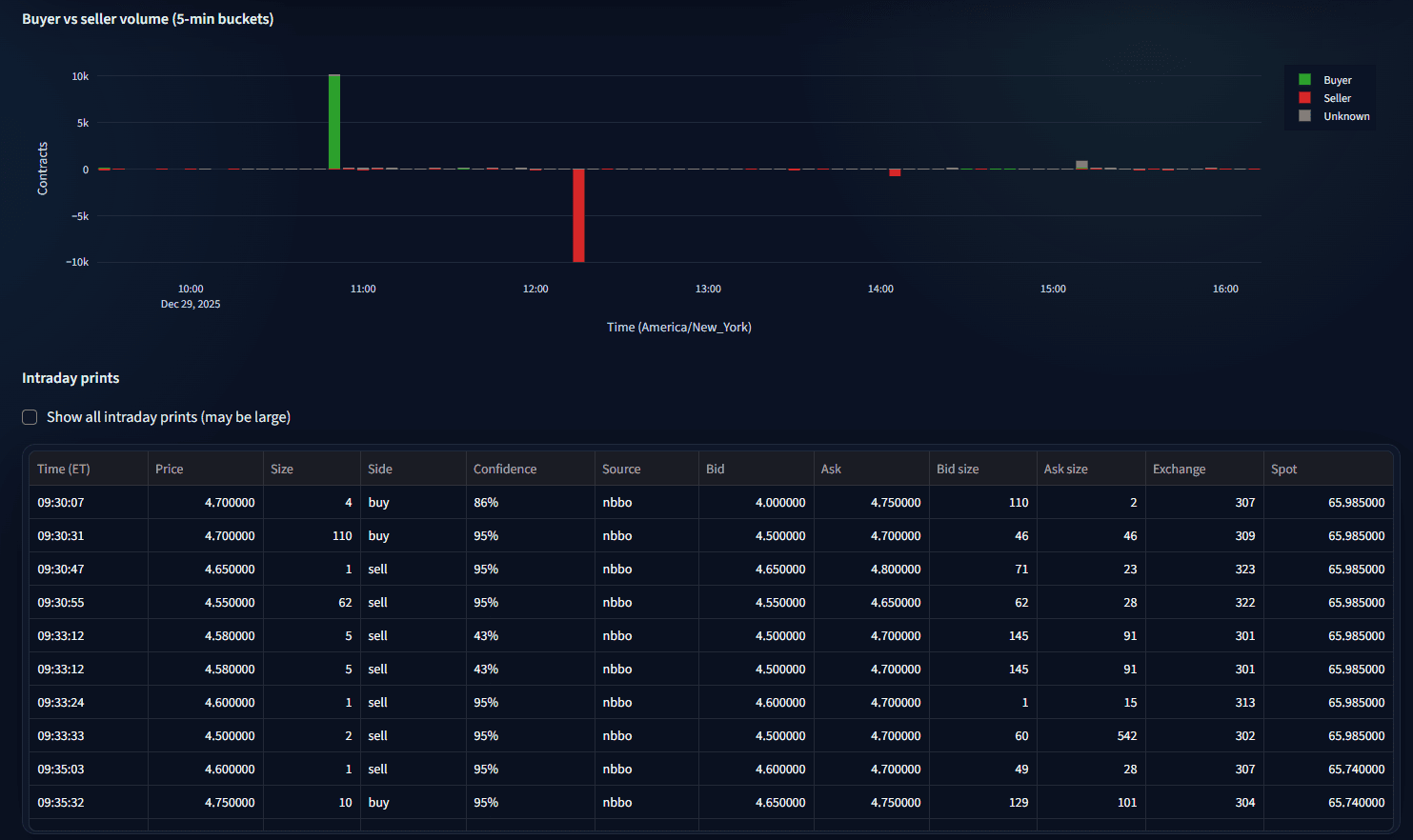

Granular Trade-Level Intelligence

Drill down to intraday, print-level option trades to trace whale activity in real time. Inspect execution price vs NBBO, timing clusters, and aggressor side to understand how positions are built. Use granular flow data to validate AI-detected strategies instead of trusting opaque signals.

- Per-trade flow analysis

- NBBO price inspection

- Execution timing clusters

Simple, Transparent Pricing

Start free, upgrade when you're ready. No hidden fees, cancel anytime.

Free

Perfect for exploring the platform

- View scatter plot

- Hover ticker info

- Market status

- Ticker search

- Click for drilldown

- Intraday charts

- Historical data

- Contract breakdown

- Large orders table

- Per-trade flow

- AI Whale Reports

- Report history

Pro

Full access for serious traders

- View scatter plot

- Hover ticker info

- Market status

- Ticker search

- Click for drilldown

- Intraday charts

- Historical data

- Contract breakdown

- Large orders table

- Per-trade flow

- AI Whale Reports (5/day)

- Report history

You'll be asked to sign in first

All prices in USD. Subscriptions billed monthly via PayPal. Cancel anytime with one click.

Not financial advice. Options trading involves risk of loss.